Home Loan Refinancing Options for People with Bad Credit

Home Loan Refinancing Options for Individuals with Bad Credit

Over the past few years, many Americans have refinanced their home loans to take advantage of the low interest rates. But, the low rates are not offered to all homeowners. Currently, the 30 year fixed interest rate is around 4.35%. This is only available to borrowers with good credit. Those with poor credit standing are usually given higher rates than the average.

People with bad credit who are seeking a refinance loan from Bank of America or Countywide must know that they need a credit score of at least 740 to qualify for the 30 year fixed interest rate of 4.5% or below. Moreover, their debt to income ratio must fall below 40% in order to be qualified for this refinance rate.

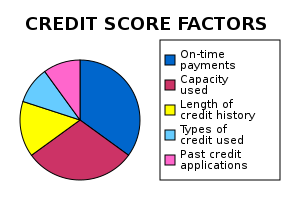

Sadly, the reality is, these are very difficult requirements to meet for people with poor credit. However, if they are determined to take advantage of good rates, they must try to boost their score by paying down their debts especially the ones incurring high interests. These include credit cards, payday loans and personal loans.

Moreover, even if Bank of America is considered as one of the country’s major financial institution, the low rates are not only exclusive to them. It is a common misconception of Americans with bad credit that not many lenders would want to work with them. In fact, there are plenty of institutions that are looking for customers and would welcome anyone regardless of his or her credit standing.

The website of FDIC provides a list of the mortgage lenders who can help in refinancing a home loan no matter what the status of the borrower’s credit is. There are about 7000 financial institutions all over the country with FDIC insurance that can provide assistance in home loan refinancing with the lowest mortgage rates of interest.

Related articles

- Homeowners Shortening Mortgage Terms At Record Rates (inquisitr.com)

- Mortgage Refinancing Activity Continues to Rise (johnmurphyreports.com)