Obtaining a Mortgage with Bad Credit

Obtaining a mortgage with bad credit

Obtaining a mortgage with bad credit these days is almost impossible. Because of the poor economy, and the problems the United States experienced during the credit crunch and the housing bubble bursting, banks and lending institutions are wary of lending money to anyone that has less than stellar credit.

If you have bad credit, and are wanting to get a mortgage to buy a house, one of the first things you should condider doing is getting your credit report. Once a year you can get your credit report for free from freecreditreport.com

When you have this, you can find out what is causing your credit to be bad. There may also

be mistakes on the credit report and you can get t hem fixed. By doing this, you can effectively raise your credit score.

A few things you want to do is pay off your debt. Right now, lending institutions are lending for people that have a low debt to income ratio. That means that you have to be making more than you are spending monthly.

Take a look at your spending habits and see if you are able to have enough left over to pay a mortgage payment, and have some left over.

In general, you should be planning on spending no more than 25-30% of your monthly income on a mortgage.

If you can’t do that, you may want to reconsider trying for a mortgage loan.

One of the things I like to suggest to people is to work on improving your credit score and save money at the same time. If you do this, you will have good credit when you buy your home, and will have the money saved.

Expect to have 20-25% of the purchase price of the home ready to make a down payment.

Also note that the better your credit score is, the lower interest rate you will qualify fo

r on the mortgage. This can save you hundreds of dollars monthly. Small changes to the interest make huge impact on the paymnets.

Ask yourself this…. do you really want to add more debt to your burded if you have bad credit? Why are you looking for very bad credit loans?

Ask youself how and why you got in this position in the first place. If you have made changes and made adjustments to your life style then good for you!

But remember, part of the credit reporting system is that your report is a snapshot in time. It is always moving and changing. And, part of the reason things tend to stay on a report for years is it takes time to change.

You want to show that you have sustained change to financial institutions.

So, before going out to see about obtaining a mortgage with bad credit, think about whether or not it really makes sense.

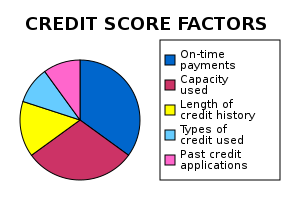

Here is a chart showing some things that are looked at when considering credit score and your ability to obtain a mortgage with bad credit.

http://youtu.be/xe0BHdxSdiU

Mortgage loans for people with bad credit

Military loans for people with bad credit

Related articles

- How to “Get and Keep” a good credit score, it’s all about your credit report! CreditCardNegotiations.com (sdfinch.wordpress.com)

- Every credit score is not created the same (usatoday.com)